The Markets

There was a gapers’ block in financial markets last week as equity investors slowed to see what the United States Treasury bond market was up to.

U.S. Treasury bonds rallied last week. Yields on 10-year Treasuries dropped from 1.43 percent at the start of the week to 1.27 percent on Thursday. The rally was quite a surprise, reported Randall W. Forsyth of Barron’s. “After all, the economy has been booming, accompanied by rising inflation – exactly the opposite of what would be conducive to lower [bond] yields and higher [bond] prices.”

As 10-year Treasury yields reached the lowest level since February, stock investors took time to consider what might have caused yields to retreat. Lower yields often suggest slower growth ahead. There may be potential for global growth to slow if:

A new wave of COVID-19 swamps the global recovery.

Twenty-four U.S. states saw the number of COVID-19 cases move higher by 10 percent or more last week, reported Aya Elamroussi of CNN. The Delta variant of the virus accounts for more than one-half of all new cases. Last week, the global death toll reached 4 million and Japan, host of the 2020 Olympic games, declared a state of emergency.

China’s banking system is in trouble.

There was another surprise last week. “…China’s central bank announced a half a percentage point cut to banks’ reserve ratio requirements, potentially increasing the profitability of their loans but also stirring concerns about the health of their balance sheets following a debt-fueled property boom,” reported Naomi Rovnick, Thomas Hale, and Francesca Friday of Financial Times.

U.S. economic growth falters as monetary and fiscal stimulus recede.

“…the bond market is now adjusting to the prospect of more moderate growth in the second half, with reduced fiscal largess and no $1,400 or $600 stimulus checks. And it’s looking ahead to the eventual prospect of the Federal Reserve throttling back its securities purchases, which currently pump $120 billion a month into the financial system,” reported Barron’s.

Investors shook off the bond market’s signal and took advantage of buying opportunities created by the dip, reported Financial Times. Major U.S. stock indices finished the week at record highs. On Friday, 10-year Treasury yields finished at 1.36 percent.

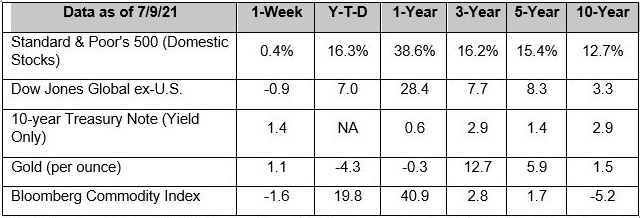

Data as of 7/9/21 | 1-Week | Y-T-D | 1-Year | 3-Year | 5-Year | 10-Year |

| Standard & Poor’s 500 (Domestic Stocks) | 0.4% | 16.3% | 38.6% | 16.2% | 15.4% | 12.7% |

| Dow Jones Global ex-U.S. | -0.9 | 7.0 | 28.4 | 7.7 | 8.3 | 3.3 |

| 10-year Treasury Note (Yield Only) | 1.4 | NA | 0.6 | 2.9 | 1.4 | 2.9 |

| Gold (per ounce) | 1.1 | -4.3 | -0.3 | 12.7 | 5.9 | 1.5 |

| Bloomberg Commodity Index | -1.6 | 19.8 | 40.9 | 2.8 | 1.7 | -5.2 |

Weekly Focus – Think About It

“A champion is someone who does not settle for that day’s practice, that day’s competition, that day’s performance. They are always striving to be better. They don’t live in the past.”

– Briana Scurry, Former goalkeeper, U.S. Women’s National Soccer Team

Best regards,

Kevin Theissen