The Markets

They say people watching the same event often see different things. That seems to have been the case last week when share prices of a few companies experienced tremendous volatility.

Some cast the events as a David vs. Goliath morality tale, however, Michael Mackenzie of Financial Times saw it differently. He wrote, “…a speculative surge from retail investors using borrowed money…has in the past signaled a frothy market top.” (In financial lingo, a market is ‘frothy’ when investors drive asset prices higher while ignoring underlying fundamentals.)

No matter how you characterize it, the events of last week were unusual. Felix Salmon of Axios explained, “Almost never does a stock trade more than twice its market value in a single day…It has happened 7 times this week already, and 20 times this month…What we’ve seen in the past month, and especially the past week, is certain companies becoming little more than vehicles for short-term gambling.”

While the social-media-driven trading spectacle was fascinating, it overshadowed other substantive news that may affect more companies over a longer period of time:

- The Federal Reserve left interest rates unchanged near zero. Fed Chair Jerome Powell indicated rates will remain low until jobs have recovered, even if inflation moves beyond the Fed’s target rate, reported Joy Wiltermuth and Andrea Riquier of MarketWatch.

- The economy continued to grow during the fourth quarter of 2020. The Bureau of Economic Analysis reported gross domestic product (GDP), which is the value of all goods and services produced, increased from the third to the fourth quarter of 2020. The pace of growth slowed significantly from the third quarter as the coronavirus continued to interfere with economic activity.

- A highly anticipated vaccine proved less effective than anticipated. Markets responded negatively to the news that a single-shot vaccine was 66 percent effective globally. The value of the vaccine is greater than the statistic suggests, according to experts cited by Ben Levisohn of Barron’s. The shot, “…prevented severe symptoms in 85 percent of patients, meaning that even those who caught the virus had cough, sniffles, and fevers but avoided the worst outcomes…”

- Company earnings in the fourth quarter were better-than-expected. On Friday, John Butters of FactSet wrote, “Overall, 37 percent of the companies in the S&P 500 have reported actual results for Q4 2020 to date. Of these companies, 82 percent have reported actual EPS [earnings-per-share] above estimates…”

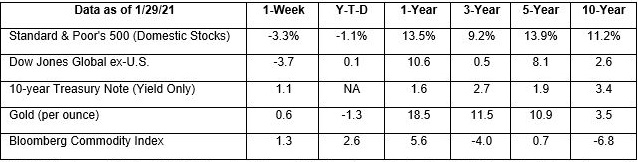

Last week, major U.S. stock market indices finished lower.

What’s New?

In January, the Merriam Webster Dictionary added 520 words to its pages. The additions include new words that have found their way into common use, as well as expanded definitions for words that were already well-established. Here is a sampling of the new entries:

- Hygge: A cozy quality that makes a person feel content and comfortable

- Pod: A small group of people who interact closely while minimizing outside contact to avoid exposure to a contagious disease

- Hard pass: A firm refusal or rejection

- Cancel culture: The practice of engaging in mass canceling as a way of expressing disapproval and applying social pressure

- Crowdfunding: Obtaining needed funding by asking a large number of people, usually members of an online community, for contributions

Gig worker: A person who works temporary jobs as an independent contractor or freelancer

- Second gentleman: The husband or male partner of a vice president or second in command of a country or jurisdiction

As new words become common or expand their meanings, other words become obsolete. What are some words that explained the world when you were younger and have fallen out of use? Britches, floppy disk, icebox, and yuppie come to mind.

Weekly Focus – Think About It

“For last year’s words belong to last year’s language

And next year’s words await another voice.”

–T.S. Eliot, Poet, editor, playwright

Best regards,

Kevin