August 2021

U.S. Markets

Last month, the stock market posted a solid gain, overcoming investors’ fears of higher inflation and an increase in COVID-19 cases.

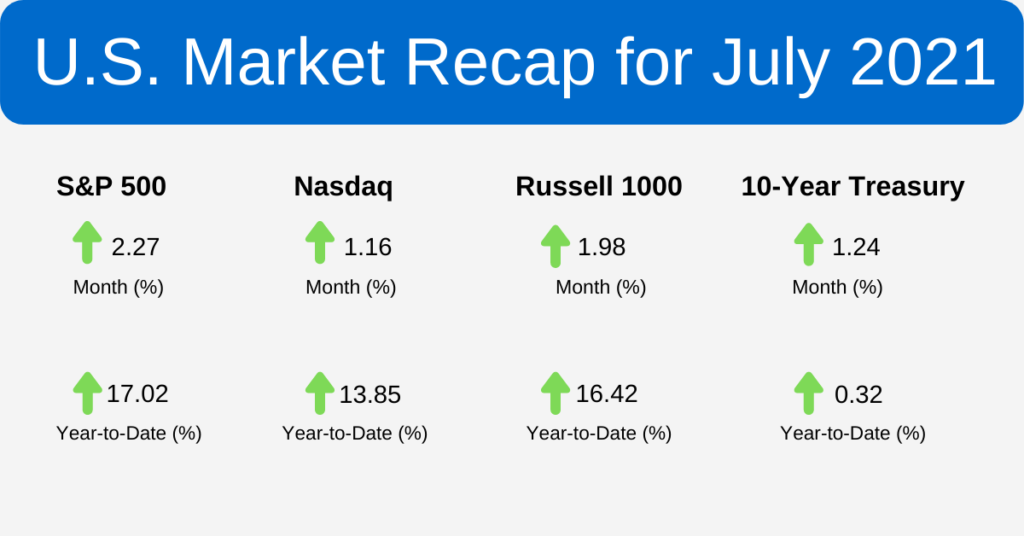

The Dow Jones Industrial Average picked up 1.25 percent, while the Standard & Poor’s 500 Index gained 2.27 percent. The Nasdaq lagged, climbing 1.16 percent.

A Wall of Worry

Climbing a wall of worry, investors weathered a choppy month as markets digested a jump in consumer prices and the continued spread of the Delta variant.

Inflation, which has been an increasing concern, hit levels not seen in decades. Consumer prices in June rose 5.4 percent, the biggest monthly gain since 2008. Meanwhile, producer prices, often a harbinger of future consumer prices, surged 7.3 percent from a year earlier. But both reports were primarily met with a collective shrug by investors.

More troubling, however, was the global spread of the Delta variant. Throughout the month, investor anxiety grew around fears that a resurgence of COVID-19 cases could stall further economic recovery.

Corporate Profits

As July closed, 221 Standard & Poor’s 500 companies had reported earnings, with 91 percent of those companies beating Wall Street’s estimates. Companies also reported strong sales, topping estimates by nearly 24 percent.

Stocks took a breather in the final week, despite the Federal Reserve’s renewed assurances that its near-zero interest rate policy would remain in place.

Sector Scorecard

Energy was the only industry sector that fell last month, declining 5.68 percent. Otherwise, gains were posted in Communication Services (+1.92 percent), Consumer Discretionary (+3.26 percent), Consumer Staples (+2.82 percent), Financials (+0.77 percent), Health Care (+4.76 percent), Industrials (+1.92 percent), Materials (+1.94 percent), Real Estate (+3.47 percent), Technology (+3.84 percent), and Utilities (+5.02 percent).

What Investors May Be Talking About in August

The rise in global COVID-19 cases last month unsettled investors, who worried about what it could mean for economic growth.

Some expect the recent surge to peak in August, while others see a peak in mid-September to early October.

Any new surge is unlikely to mirror the experience in 2020. However, some investors may remain watchful as local, state, and federal entities weigh further restrictions.

World Markets

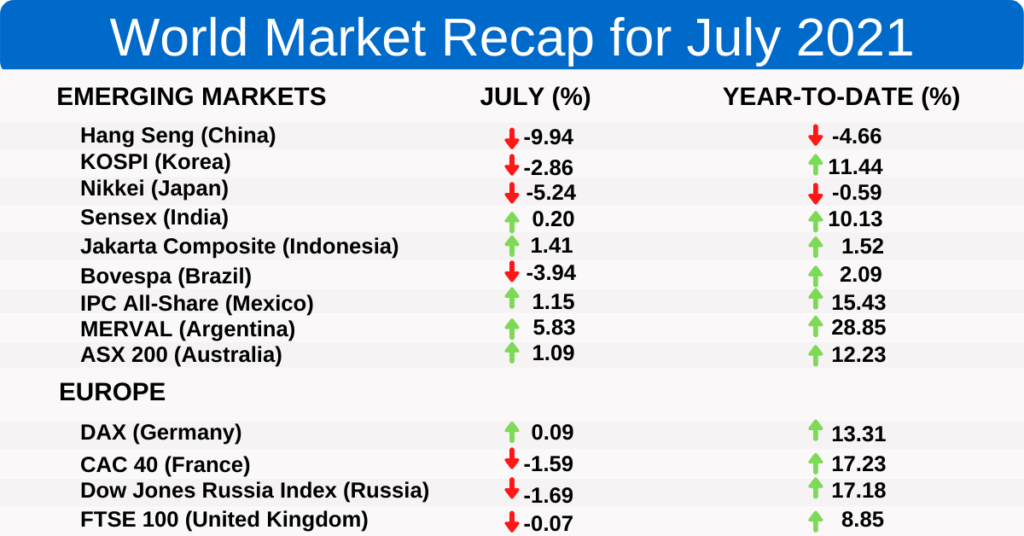

The MSCI-EAFE Index trended higher, picking up 1.60 percent in July. However, different parts of the globe showed mixed results.

In Europe, France was under pressure, dropping 1.69 percent, while Germany (+0.09 percent) and the U.K. (+0.07) posted modest gains.

Australia rose 1.09 percent to lead the Pacific Rim markets. But Hong Kong dropped 9.94 percent as Chinese regulators continue their push to rein in large companies for reasons that include data security, corporate behavior, financial stability, and curtailing private-sector power.

Indicators

- Gross Domestic Product (GDP)

The economy grew by an annualized rate of 6.5 percent in the second quarter. The growth rate, however, was well below economists’ expectations of 8.4 percent.

- Employment

Employers added 850,000 new jobs in June, marking the most significant increase since August 2020. However, the unemployment rate ticked higher to 5.9 percent due to a larger number of Americans seeking employment.

- Retail Sales

Retail sales rose 0.6 percent, despite a two percent decline in auto sales. Sales were particularly strong at restaurants, bars, and clothing stores.

- Industrial Production

Industrial production increased 0.4 percent, though manufacturing output declined due to reduced automobile production.

- Housing

Housing starts rose 6.3 percent in June, exceeding economists’ expectations. Sales of existing homes rose 1.4 percent after four consecutive months of declines. Inventories ticked higher, while demand softened a bit. New home sales slumped 6.6 percent, suggesting that high prices are cutting into demand.

- Consumer Price Index (CPI)

Consumer prices jumped by 5.4 percent in June, registering the highest 12-month rate of change since August 2008. The core CPI, which excludes the more volatile food and energy sectors, increased by 4.5 percent.

- Durable Goods Orders

New orders for durable goods rose 0.8 percent in June. This is the thirteenth month out of the last 14 in which durable goods orders registered a gain.

- The Fed

The Federal Reserve reaffirmed that its monthly bond purchase program would continue until the Fed sees substantial progress in its inflation and employment goals. Some analysts have suggested that the Federal Reserve’s assessment of economic progress was potentially a hint that the tapering of bond purchases may be close.

“Our asset purchases have been a critical tool. They helped preserve financial stability and market functioning early in the pandemic and, since then, have helped foster accommodative financial conditions to support the economy.”

Federal Reserve Chair Jerome Powell