August 9, 2021

The Markets

Are we there yet?

For months, investors have wondered when the Federal Reserve (Fed) might begin to “normalize” its policies, a process that will, eventually, lead to higher interest rates. Last week, a better-than-expected unemployment report – showing a gain of almost a million jobs – sparked speculation about whether we’ve arrived at that point. It’s difficult to know.

When the pandemic arrived, the Fed adopted policies that stimulated growth. It also cut short-term interest rates to zero and began buying Treasuries and agency mortgage-backed securities to keep long-term rates low. Low rates make borrowing less expensive for businesses and individuals, reported the Brookings Institute. That’s important in economically challenging times.

In late July, the Fed said it would continue to keep rates low and buy bonds until it saw “substantial further progress toward maximum employment and price stability [inflation] goals.”

The Fed may have already achieved its inflation goal. Its favorite inflation gauge is called Personal Consumption Expenditures (PCE), excluding food and energy. It’s a statistic that reflects changes in how much Americans are paying for goods and services. In June, the Bureau of Economic Analysis reported that PCE was up 3.5% year over year. That’s well above the Fed’s 2% inflation target; however, the Fed’s new policy is to overshoot its target before raising rates.

If July’s employment numbers satisfy the Fed’s expectations for progress on jobs, the Fed may begin the process of normalizing monetary policy. The first step would be purchasing fewer bonds, a practice known as tapering.

“Many market watchers are looking for [Fed Chair] Powell to discuss tapering at the central bank’s big policy meeting at Jackson Hole, Wyo., this month.”

Randall Forsyth, Barron’s

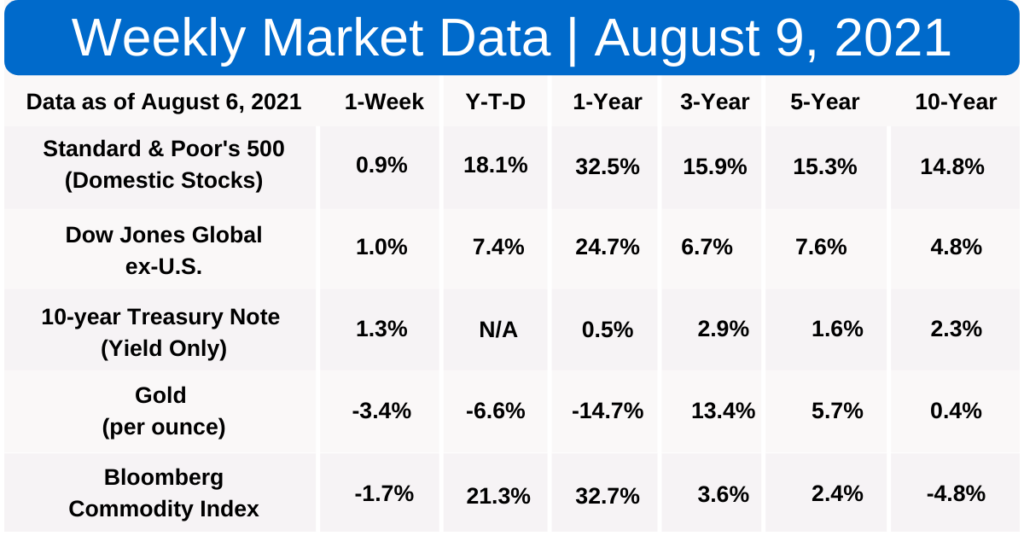

Major U.S. stock indices finished the week higher, according to Barron’s, and so did the yield on 10-year U.S. Treasuries.

WHAT’S MAKING US MORE PRODUCTIVE?

While the United States has not yet recovered all of the jobs lost during the pandemic – 22 million were lost and 16.6 million have returned – productivity is higher than it was when more people were employed.

“Though output reached a new high in the second quarter, employment remained more than 4% below its pre-pandemic level… . At present, America is producing more output than it managed just a year and a half ago, with roughly 6 [million] fewer workers.”

The Economist

Higher productivity undoubtedly reflects the ingenuity of American businesses. The pandemic forced companies to find ways to remain productive. In response, many adopted new technologies, implemented new patterns for working, and changed their business models.

However, not all companies have experienced gains in productivity, reported Eric Garton and Michael Mankins in the Harvard Business Review. Those that proved to be the best at managing time, talent and energy – the top 25% of companies – were 40% more productive than other companies. (The productivity of companies in the lower quartiles was averaged to make the comparison.)

Not all sectors of the economy are equally productive, either:

“The surge in output per worker also reflects the changing mix of the workforce. Employment in the leisure and hospitality industries, where productivity tends to be low, remains about 10% below the pre-pandemic level, compared to a 3% shortfall in the higher-productivity manufacturing sector.”

The Economist

As less productive sectors recover, productivity may return to previous levels. In the meantime, some employees have been wondering whether it’s necessary to return to the workplace, as productivity has been high while they’ve been working remotely. In an early July survey conducted by The Conference Board, a majority (56%) of employees asked whether returning to the workplace was wise, but just 18% of chief executive officers shared the concern.

Weekly Focus – Think About It

“Whenever you are asked if you can do a job, tell ’em, ‘Certainly I can!’ Then get busy and find out how to do it.”

—Theodore Roosevelt, 26th president of the United States