August 23, 2021

The Markets

Last week, markets were shaken by a potent cocktail of central bank tapering and economic growth concerns – mixed with coronavirus and a splash of new Chinese privacy law.

On Wednesday, the U.S. Federal Reserve’s Open Market Committee Meeting minutes were released. They confirmed the Fed could begin tapering – buying fewer Treasury and U.S. government agency bonds – sooner rather than later, reported Barron’s. While that information wasn’t new, it startled investors like cats encountering cucumbers, and triggered a broad sell-off.

In the U.S., economic data was mixed, after the Census indicated that retail sales declined in July, suggesting weakening consumer demand. Normally, that’s not great news because consumer demand drives U.S. economic growth. However, with inflation at the highest level in more than a decade, lower demand could help relieve upward price pressure.

Lower consumer demand was accompanied by improving supply:

“…business inventories rose in June at the fastest clip since October as wholesalers and manufacturers posted solid increases and retailers saw inventories rise for the first time in three months. From a year earlier, inventories across American businesses rose 6.6%, compared with a 4.6% pace a month earlier.”

Lisa Beilfuss, Barron’s

Of course, supply bottlenecks could return, if another COVID-19 surge drives new lockdowns and ongoing worker shortages.

On Friday, Beijing’s announcement of a new, strict data-privacy law (to take effect on November 1) caused a sharp drop in Chinese stocks. Investors remain concerned that China’s regulatory tightening will affect other market sectors, including fintech, gaming, and education, reported the Financial Times.

“American investors’ shock at an ongoing regulatory crackdown in China points to a fundamental difference between the two countries…whereas the U.S. system is designed to let corporations influence the government, China’s system is designed to bring corporations in line with government goals.”

Evelyn Cheng, CNBC

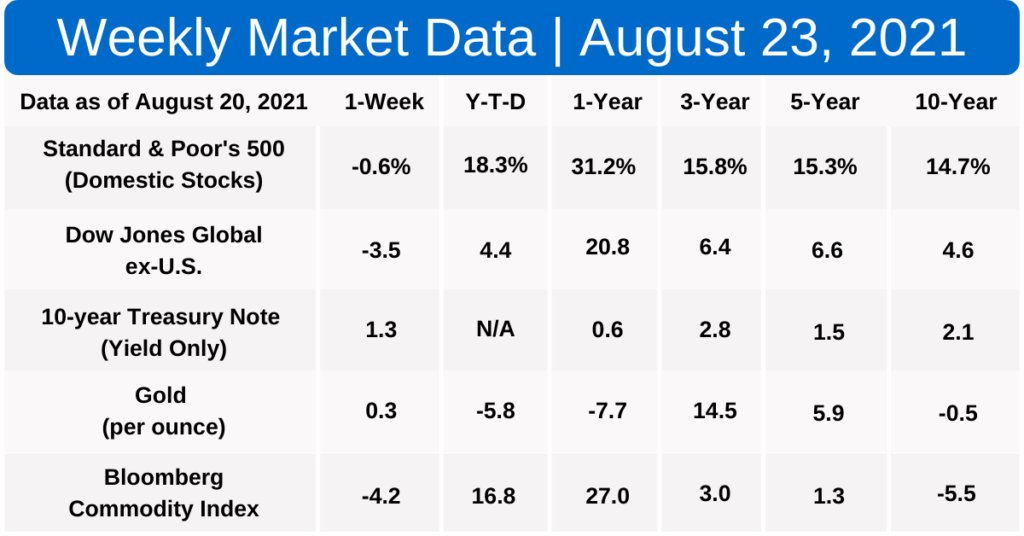

Major U.S. stock indices finished the week lower. The yield on 10-year U.S. Treasuries finished the week where it started.

Picking the right place to live…The COVID-19 pandemic caused many of us to reconsider how and where they want to live. People relocate for a variety of reasons: They may want to be closer to family and friends, live in a more affordable place with lower taxes or with better employment opportunities.

Another reason people relocate is climate. It seems that climate risk is affecting personal and business investment decisions in an increasingly meaningful way. Many people move to regions with better climates, but now they also are avoiding areas with high climate risk.

The influence of climate change on relocation decisions varied by age and location:

- People age 55 and older were less likely to factor climate risk into relocation decisions

- Younger respondents, especially 35- to 44-year-olds, prioritized climate risk issues

- A majority of respondents of all ages said they would hesitate to buy homes in areas with natural disasters, extreme temperatures or rising sea levels, regardless of whether they intended to move.

- Those who lived in the northeastern and southern U.S. and planned to move were most concerned about the frequency and intensity of natural disasters

- Residents in western states were most concerned about extreme temperatures.

- Midwesterners are concerned about both the frequency/intensity of natural disasters and extreme temperatures

“About half of respondents who plan to move in the next year said extreme temperatures and/or the increasing frequency or intensity of natural disasters played a role in their decision to relocate. More than a third (36%) said rising sea levels were a factor.”

RedFin

Home buyers aren’t the only ones thinking about climate risks. A real estate developer told Swapna Venugopal Ramaswamy of USA Today:

“…real estate investors such as banks and insurance companies used climate risk data to inform their investing decisions.”

Weekly Focus – Think About It

“The evidence on climate risk is compelling investors to reassess core assumptions about modern finance…Will cities, for example, be able to afford their infrastructure needs as climate risk reshapes the market for municipal bonds… . How can we model economic growth if emerging markets see their productivity decline due to extreme heat and other climate impacts? Investors are increasingly reckoning with these questions and recognizing that climate risk is investment risk.”

Larry Fink, BlackRock Chairman and Chief Executive Officer