September 2021

U.S. Markets

Signs of an improving labor market, strong corporate earnings, and more clarity from the Fed on its tapering plans propelled stocks to multiple record highs during August.

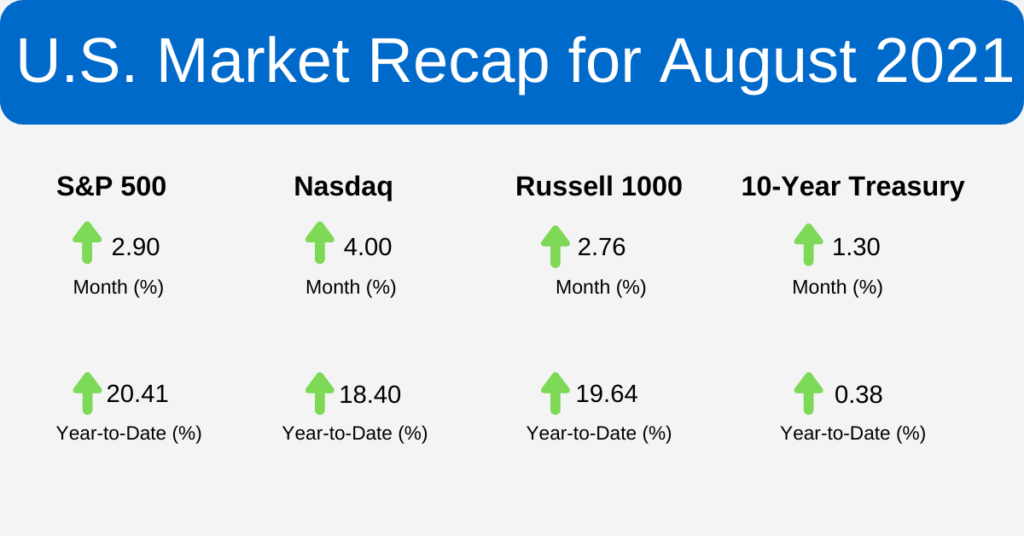

The Dow Jones Industrial Average gained 1.22%, while the Standard & Poor’s 500 index rose 2.90% . The Nasdaq Composite led, picking up 4.00% , according to The Wall Street Journal (WSJ).

Corporate Earnings

Corporate profits in the second quarter were, by all measures, exceptional. With 98% of companies in the S&P 500 index reporting, 89% beat Wall Street consensus estimates, by an average of 17.7% . The companies posted an earnings-per-share growth of nearly 92% over the second quarter of 2020.

The labor market also showed signs of improving health, providing evidence that the economic recovery remained intact. The WSJ reported that jobless claims in August reached pandemic lows, while employers added 953,000 jobs in July, and job openings reached record levels.

The Fed at Center Stage

In the final days of trading, Fed Chair Jerome Powell stated that the Fed might begin to pare back its monthly bond purchases before year-end. Powell’s update followed multiple comments from regional Federal Reserve Bank presidents indicating their support for reducing bond purchasing. It’s important to note that Powell said that tapering should not be seen as an indicator of future changes in interest rates.

Covid Worries

The month was not without its worries. The global spread of the Delta variant resulted in flashes of investor anxiety that led to temporary pullbacks in stock prices. New COVID-19 cases in the U.S. rose throughout August, raising concerns that spreading infections could derail the economic recovery.

In Asia, outbreaks closed some shipping ports. Vietnam partially halted manufacturing, and Japan extended its lockdown protocols. These actions raised concerns about their supply chain impact and what it may mean for inflation and economic growth.

Sector Scorecard

For the second straight month, energy was the only industry sector under pressure. Energy lost 1.34% in August. Otherwise, gains were posted in Communication Services (+3.52%), Consumer Discretionary (+1.54%), Consumer Staples (+0.83%), Financials (+5.28%), Health Care (+2.45%), Industrials (+1.39%), Materials (+2.19%), Real Estate (+2.20%), Technology (+4.1%), and Utilities (+4.02%).

What Investors May Be Talking About in September

Since the early days of the pandemic, Fed Chair Jerome Powell has maintained that accommodative monetary policies would remain unchanged until the economy recovered. He’s been clear that the Fed would be very transparent in communicating monetary policy changes well ahead of implementing them to allow the capital markets sufficient time to digest any change.

Comments by a number of Federal Reserve Bank regional presidents last month may have heralded the beginning of a communication plan.

Is the Fed Changing Course?

First, the Federal Reserve Banks of Atlanta and Richmond made comments suggesting that the time to begin tapering was nearing. Reuters reported that this was followed days later by remarks from the Federal Reserve Banks of Dallas and Kansas City, indicating that the economy had progressed enough to commence tapering as early as October.

September 22 Meeting

Talk of tapering grew louder with the August 18th release of the Federal Open Market Committee (FOMC) meeting minutes, suggesting that the Fed may be ready to scale back its bond purchases before year-end.

Finally, a speech by Fed Chair Jerome Powell near the end of the month confirmed that the Fed was getting closer to the start of tapering. Powell indicated that tapering could begin before year-end in his prepared comments, though he cautioned against connecting tapering with an interest rate hike.

For many market observers, the Fed appears to be signaling that its September meeting may lead to changes in language and policy. The two-day meeting ends on September 22nd.

World Markets

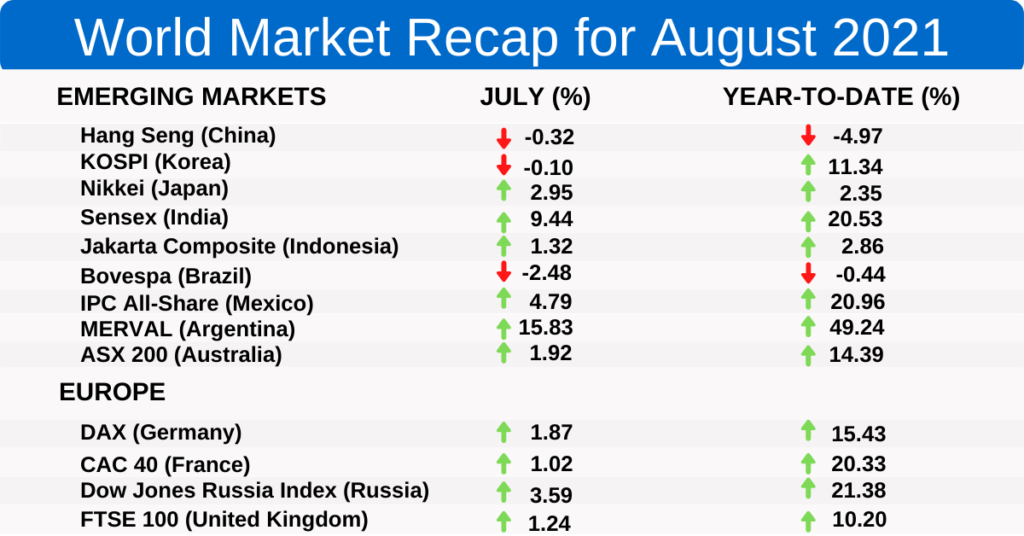

A strong U.S. equity market helped push international stocks higher, with the MSCI-EAFE Index advancing 1.60% in August.

In Europe, Germany tacked on 1.87%, the U.K. added 1.24%, and France picked up 1.02%.

The Pacific Rim markets were mixed. Japan rose 2.95%, and Australia rose 1.92%. However, China’s Hang Seng index and Korea’s KOSPI edged lower, according to MSCI.com.

Indicators

Gross Domestic Product

The pace of economic growth in the second quarter was revised upward slightly, from 6.5% to a 6.6% annualized rate (CNBC).

Employment

Employers added 943,000 new jobs in July—the biggest jump since August 2020. The unemployment rate fell to 5.4%, down from June’s 5.9% rate (WSJ).

Retail Sales

Retail sales cooled in July, falling 1.1%, led by a decline in auto purchases. Retailers attributed the weakness to the spread of the Delta variant (WSJ).

Industrial Production

Output at the nation’s factories, mines, and utilities rose 0.9%, led by a 1.4% rise in manufacturing production. July’s result topped the consensus estimate of a 0.5% increase (WSJ).

Housing

Housing starts slid 7.0% as challenges with land, labor, and materials persisted (Bloomberg).

Existing home sales rose 2.0% as limited inventory and strong demand drove the median price higher by nearly 18% from July 2020, to $359,900 (WSJ).

For the first time in four months, new home sales rose, increasing 1.0% as the median sales price jumped 18.4% to a record level of $390,500 (Bloomberg).

Consumer Price Index (CPI)

Consumer prices climbed at their fastest rate since 2008, rising 0.5% in July and by 5.4% year-over-year (WSJ).

Durable Goods Orders

New orders of goods designed to last three years or more declined 0.1% in July, dragged down by a nearly 50% drop in nondefense aircraft and parts (WSJ).

The Fed

Minutes from the July 27–28 FOMC meeting revealed that some appeared ready to slow the pace of monthly bond purchases by the end of the year (WSJ).

“Various participants commented that economic and financial conditions would likely warrant a reduction in coming months,” according to the minutes.

“Several others indicated, however, that a reduction in the pace of asset purchases was more likely to become appropriate early next year because they saw prevailing conditions in the labor market as not being close to meeting the Committee’s ‘substantial further progress’ standard or because of uncertainty about the degree of progress toward the price-stability goal.” (FederalReserve.gov)