October 18, 2021

Don’t get spooked!

Barron’s Big Money Poll is an exclusive survey of market sentiment among professional investors. Last week, Nicholas Jasinski reported on 2021’s findings:

“America’s money managers are optimistic about the long-term outlook for the economy, the financial markets, and the recovery from the [COVID-19] pandemic. It’s the short-term prognosis that concerns them. Monetary and fiscal policies are in flux. Supply-chain bottlenecks and labor shortages are igniting inflation and threatening corporate profit margins, and the economic recovery from 2020’s recession –so robust until now – is decelerating. Add pricey stock valuations and rising bond yields, and the immediate future suddenly looks more challenging than the recent past.”

Among those surveyed by Barron’s, half are bullish about prospects for the next 12 months, down from 67 percent last spring. Twelve percent are bearish, up from seven percent last spring, and the rest are neutral.Fifty percent said stock markets are fairly valued at current levels, and 80 percent anticipate a stock market correction – a drop of about 10 percent from a recent high – during the next six months.

Market corrections are not all that unusual. The average correction lasts a few months, reported James Chen on Investopedia.That’s long enough, though, for loss aversion to kick in. Research has found that, psychologically, the pain from loss is twice as powerful as the pleasure from gain. As a result, when markets decline, loss aversion causes some investors to wonder whether they should make changes to their investment strategies and that can have a negative impact on long-term financial goals.

There is no way to know whether a correction is ahead. That said, if a market downturn has you wondering about your investment strategy, please get in touch. We can discuss whether changes should be made.

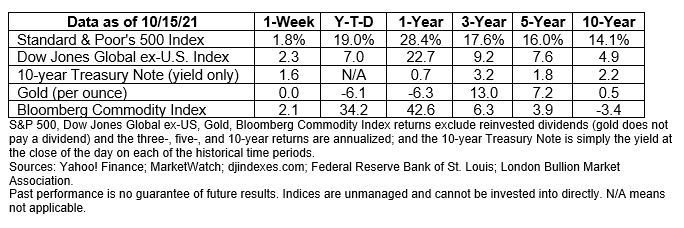

Last week, major U.S. indices finished the week higher, and the yield on a 10-year U.S. Treasury moved lower.