November 1, 2021

The Markets

The road to recovery is slow and bumpy.

Last week, we learned that economic growth slowed in the third quarter as a new wave of COVID-19 surged across the United States, reported The Bureau of Economic Analysis. Gross Domestic Product (GDP), which is the value of all goods and services produced in the United States, increased by 2 percent annualized in the third quarter.

Consumer spending dropped sharply during the period. The change may reflect the limited availability of goods due to supply-chain issues, a reluctance to pay higher prices, or a drop in disposable personal income. Jeff Cox of CNBC reported:

“Spending for goods tumbled 9.2%, spurred by a 26.2% plunge in expenditures on longer-lasting goods like appliances and autos, while services spending increased 7.9%, a reduction from the 11.5% pace in [the second quarter]. The downshift came amid a 0.7% decline in disposable personal income, which fell 25.7% in [the second quarter] amid the end of government stimulus payments. The personal saving rate declined to 8.9% from 10.5%.”

Despite slower economic growth and lower consumer spending, many companies remained highly profitable during the third quarter. At the end of last week, John Butters of FactSet reported:

“At this point in time, more S&P 500 companies are beating EPS [earnings-per-share, which is a measure company profits] estimates for the third quarter than average, and beating EPS estimates by a wider margin than average…The index is now reporting the third highest (year-over-year) growth in earnings since [second quarter] 2010. Analysts also expect earnings growth of more than 20% for the fourth quarter and earnings growth of more than 40% for the full year.”

It appears that public companies remain adaptable and resilient despite the ongoing challenges created by the pandemic.

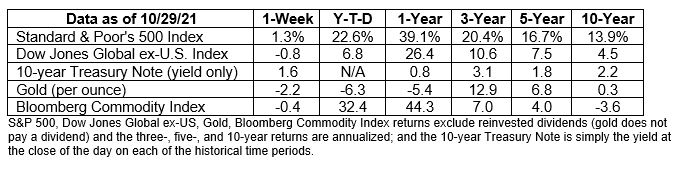

Last week, the three major U.S. stock indices finished the week at record highs, according to Ben Levisohn of Barron’s.The Treasury yield curve flattened as yields on longer-term U.S. Treasuries also moved lower.