| U.S. Markets |

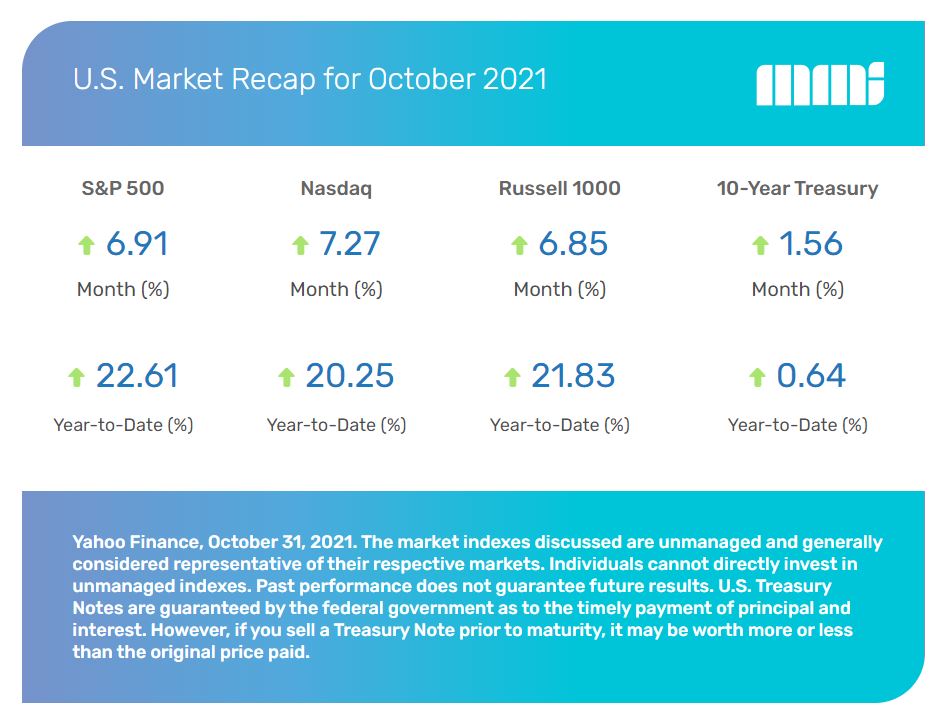

| A strong corporate earnings season renewed investor enthusiasm for stocks and propelled the market to healthy gains in October.The Dow Jones Industrial Average advanced 5.84 percent while the Standard & Poor’s 500 Index rose 6.91 percent. The Nasdaq Composite led, surging 7.27 percent.1 Powerful One-Two Punch After a difficult September, the markets rallied with a sense of conviction thanks to a string of positive economic reports and a strong start to earnings season. The encouraging succession of economic reports allayed investor worries about inflationary pressures and economic deceleration, while a wave of corporate earnings releases provided fresh upside surprises that suggested that American businesses had weathered the worst of the Delta variant surge. Inside the Number With about half of the S&P 500 constituent companies having reported earnings, more than 80 percent of them have beaten Wall Street analysts’ consensus estimates. Based on these results so far, earnings are expected to come in approximately 39 percent above the third quarter last year.2 Looking Past Nearly lost in October’s rally were two important developments. First, the FOMC (Federal Open Market Committee) detailed the expected size and pace of its bond market tapering. Despite the step toward a less accommodative monetary policy, investors greeted it with a collective shrug. Tax Uncertainty Lifting Second, the market appeared to look past the possibility of a change in corporate tax rates to help pay for the proposed social and climate spending bill. As legislators narrowed the range of the spending bill framework, the prospect of higher corporate taxes dimmed, which may have provided an additional lift to stock prices. Sector Scorecard Every industry sector moved higher in October except Communications Services, which saw a marginal loss of 0.47 percent. Performance was strong across the board, with gains in Consumer Discretionary (+10.05 percent), Consumer Staples (+2.66 percent), Energy (+9.38 percent), Financials (+6.09 percent), Health Care (+3.64 percent), Industrials (+4.69 percent), Materials (+6.00 percent), Real Estate (+7.84 percent), Technology (+6.81 percent), and Utilities (+5.90 percent).3 What Investors May Be Talking About in November In the month ahead, expect news events from Washington to continue to drive some market activity. One issue that may make headlines is the federal debt ceiling, which is expected to be resolved before early December. Raising the debt ceiling will allow the federal government to pay its bills, including interest payments on Treasuries and government programs. But the markets might get unsettled the closer the debt ceiling deadline approaches without a legislative agreement. Uncertainty represents a risk that can manifest itself in price volatility. World Markets Many overseas markets followed Wall Street’s lead, with the MSCI-EAFE Index gaining 3.21 percent in October.4 Major European markets performed well, with advances in France (+4.76 percent), Germany (+2.81 percent), and the U.K. (+2.13 percent).5 Pacific Rim stocks were mixed, with the Hang Seng market adding 3.26 percent while the Nikkei slipped 1.90 percent.6 Indicators Gross Domestic Product (GDP) Economic expansion slowed in the third quarter, as the GDP grew at an annualized rate of 2.0 percent. The spread of Delta variant and supply chain bottlenecks were the chief reasons for the slowdown from previous quarters.7 Employment The economy added 194,000 jobs, making September the slowest month for job growth this year. The unemployment rate declined to 4.8 percent, while wages rose 4.6 percent year-over-year.8 Retail Sales Retail sales rose 0.7 percent, despite constrained supply and the Delta variant. The better-than-estimated sales in September may reflect consumer strength and higher prices for goods.9 Industrial Production Industrial output fell 1.3 percent, a downside surprise from consensus expectations for a small gain. The Federal Reserve attributed about half the decline to the continuing impact of Hurricane Ida.10 Housing Burdened by a shortage of materials and labor, housing starts dropped 1.6 percent in September, dragged lower by a decrease in multi-family dwelling starts.11 Existing home sales rose 7.0 percent. The median price of existing homes increased by 13.3 percent from a year ago to $352,800.12 New home sales gained 14 percent, reaching a six-month high. The combination of low inventory and high demand led to an 18.7 percent rise in the median cost of a new home.13 Consumer Price Index (CPI) Consumer prices rose 0.4 percent in September, while over the last 12 months the inflation rate came in at 5.4 percent.14 Durable Goods Orders Durable goods orders declined 0.4 percent, lower than economists had forecasted amid labor and supply shortages.15 The Fed Minutes from September’s FOMC meeting revealed greater details surrounding the Fed’s taper plans. The Fed would begin reducing bond purchases by $15 billion a month starting in November and concluding in July 2022. “No decision to proceed with a moderation of asset purchases was made at the meeting, but participants generally assessed that, provided that the economic recovery remained broadly on track, a gradual tapering process that concluded around the middle of next year would likely be appropriate,” according to the minutes of the two-day meeting, which concluded on September 22.16 This tapering schedule is a bit accelerated from what investors had been expecting but reflects Fed worries that supply chain bottlenecks were increasing the likelihood of more persistent inflation.17  |