December 13, 2021

Commentary

December 13, 2021

The Markets

Inflation met expectations.

When the Bureau of Labor Statistics released the Consumer Price Index (CPI) last week, it showed that inflation was at levels last seen in 1982. In November, prices were up 0.8 percent month-to-month and 6.8 percent year-to-year.

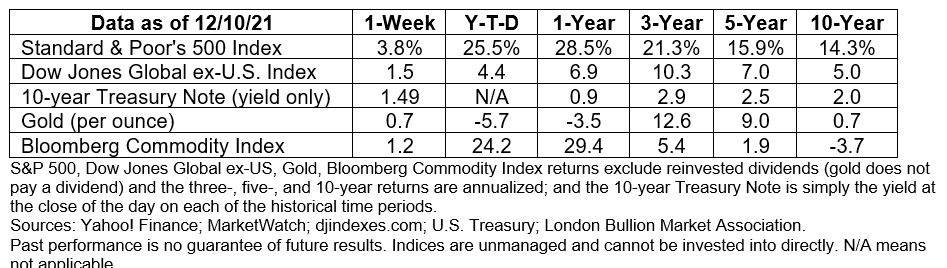

“It was the blowout, superhot inflation number that everyone was expecting—and it was met with a shrug,” reported Ben Levisohn of Barron’s. “The major indexes, for their part, rose a touch on Friday to finish what turned out to be a fantastic week: The S&P 500 gained 3.8% to hit a new high, while the Dow Jones Industrial Average rose 4.0% and the Nasdaq Composite gained 3.6%.”

The bond market’s response to the CPI was unexpected, as well. “Indeed, Treasury inflation-protected securities were saying price pressures in future years will be abating instead of getting worse,” reported Randall W. Forsyth of Barron’s.

Forsyth was referring to the breakeven rate, which is the difference in the yields of Treasuries and the yields of inflation-protected Treasuries with the same maturities. The breakeven rate is a measure of investors’ inflation expectations for the next five years. On Friday, the 5-year Breakeven Inflation Rate was 2.76 percent. That was below its November high of 3.17 percent.

The financial markets’ tepid response to the CPI sparked debate about whether inflation has peaked.

No matter which side of the argument you come down on, “The surge in inflation since the start of 2021 means that it is guaranteed to remain elevated in annual terms for a while to come. A relatively optimistic forecast would have inflation returning to its pre-pandemic norm only at the very end of 2022,” reported The Economist.