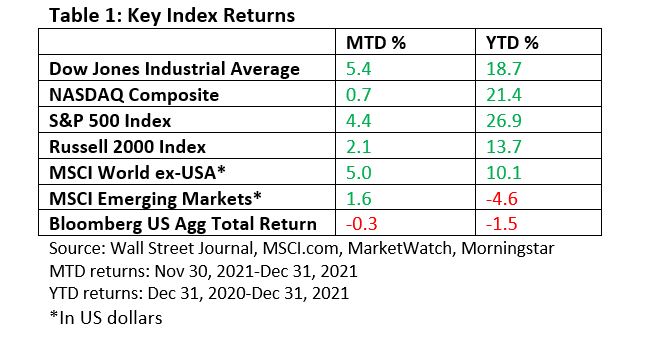

The year 2021 was a banner year for investors. The broad-based S&P 500 Index, which is made up of 500 larger U.S. companies, finished the year up 26.9%. If we included reinvested dividends, the index advanced 28.7%, according to S&P Dow Jones Indices.

Much better-than-expected corporate profits (Refinitiv), which were powered by an expanding economy, plus a super easy monetary policy compliments of the Federal Reserve, deserve much of the credit.

Low interest rates, low bond yields, and rising profits easily offset worries about the lingering pandemic and much higher-than-expected inflation.

But we are now looking ahead into 2022. What might the new year bring? After last year’s strong advance, what might be in store for this year?

Since 1950, there have been 26 years in which the total annual return of the S&P 500 Index exceeded 20%, according to data provided by the NYU Stern School of Business. In the following year, the S&P 500 Index advanced 20 times, or 77% of the time, in line with the long-term average.

The average up year was 18.1%, while the average down year was 6.4%.

It’s an interesting exercise, but let’s always remember that past performance is no guarantee of future performance. Each year will have its own distinctions.

We could add one more wrinkle. The total return of the index has doubled over the last three years, according to Dow Jones Indices.

What dictates the market’s direction will likely be the economic fundamentals and whatever impacts those fundamentals.

For example, what might the Federal Reserve do with interest rates? At the beginning of 2021, the Fed expected no rate hikes in 2022. However, it failed to anticipate last year’s surge in inflation.

As the year ended, the Fed’s new projections, which it released after its December meeting, reflected a forecast of three quarter-percentage-point rate hikes this year.

Are those potential rate hikes already being discounted by investors? If inflation fails to ease–or worse, accelerates–could the Fed take a more aggressive posture?

Let’s take this point one step further. Longer-term bond yields have remained very low in the face of a less dovish Fed, high inflation, and robust economic growth.

Will we get a reset in 2022? Or have there been fundamental changes in the bond market that are holding yields low? Or do bond investors simply believe inflation and economic growth will slow?

Corporate profits are also a key driver of stock prices. Consider this: If you were to purchase or sell a small business, wouldn’t recent and projected profitability play a big role in the sales price? It absolutely would. The same principle holds for publicly traded companies.

How will the pandemic play out? We’ve seen Delta and we’re now seeing a surge in cases tied to Omicron. The economic impact of Delta was limited, and thus far, investors have side-stepped economic worries about Omicron. But what does 2022 hold?

We’ve posed several important questions that don’t offer easy answers. We may see a pullback in 2022, and we recognize that downturns are a part of investing.

Based on your goals, circumstances, and risk tolerance, we craft portfolios that help manage risk, but we can’t eliminate risk.

If one trades the fear of a sell-off for a savings account, one won’t participate in the long-term upside that stocks have historically offered. Conversely, take on too much risk when the market has been strong, and you may experience sleepless nights in a swift downturn.

If life events have forced you to rethink your goals, let’s talk. Financial plans are not set in stone.

Yet, adherence to one’s financial plan and a long-term focus have historically been the straightest path to reaching one’s financial goals. We may see volatility next year. But predictions are simply educated guesses. As we’ve seen in the past, sell-offs, when they occur, are followed by rebounds. Keep this in mind as we navigate the New Year.

If you have any questions or would like to discuss any matters, please feel free to give me or any of my team members a call.

Looking forward to a great 2022!