October 11, 2021

The Markets

The word “jouncy” may have started life as a combination of bouncy and jolting – and it’s a pretty good way to describe what happened to stock markets last week.

The week started with the Standard & Poor’s 500 Index experiencing daily gains and losses of about one percent. Other major U.S. indices saw sizeable daily swings in value, too. Lu Wang of Bloomberg reported:

“The harrowing reversals reflect a particularly stark divide between bull and bear cases in markets right now. On one side, risk appetites are being constricted by lingering uncertainty over the government debt ceiling, tightening Federal Reserve policy and disrupted supply chains. At the same time, sentiment is being buttressed by improving [COVID-19] trends, an economy that keeps chugging along and forecasts for more double-digit earnings growth from corporate America.”

Considering how volatile things were early in the week, investors were remarkably sanguine about Friday’s less-than-stellar employment report. The Bureau of Labor Statistics indicated that less than 200,000 jobs were created in September.3 According to Ben Levisohn of Barron’s, the number was below expectations and provided relatively little insight to economic growth.

“Yes, the U.S. added just 194,000 jobs in September, well below forecasts for 500,000, and that’s the kind of miss that would suggest a slowing economy. The number, though, was close to meaningless, given the seasonal adjustments – which may have skewed it lower – and by comparison to the household survey, which showed more than 500,000 new jobs as the unemployment rate fell to 4.8%. Try making an investment decision off that.”

Consumers, investors, and central bankers are also expending a lot of energy worrying about power – the kind that’s generated by natural gas, oil, coal, wind, sun and other sources. Supply and demand issues in energy markets have caused prices to rise and is pushing inflation higher, according to Julia Horowitz of CNN Business.

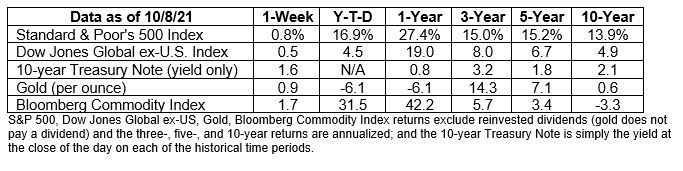

Major U.S. indices finished the week higher, although the Nasdaq Composite’s gain was just 0.1 percent.The yield on a 10-year U.S. Treasury rose to 1.6 percent.