Surprise! It was a great week for markets.

Since the U.S.-China trade conflict resumed in early May, investors have been off balance. The possibility of escalating tariffs on Mexico heightened economic uncertainty. Then, last week’s unemployment report arrived with less than stellar news – just 75,000 jobs were created in May. The number was well below expectations. The Bureau of Labor Statistics revised March and April employment numbers downward, too.

We know investors hate uncertainty. So, why did major U.S. indices rally?

The answer may be hope. There was hope negotiations with Mexico would produce results and tariffs would be avoided. There was hope trade issues with China, in tandem with less-than-stellar economic news, would encourage the Federal Reserve to cut rates. There was hope lower rates would stimulate the economy and lift share prices higher.

Investors were right about Mexico and tariffs.

On Saturday, The Wall Street Journal reported the United States and Mexico reached a last-minute agreement on immigration that takes tariffs off the table for now. It was good news. Before the agreement was reached, the vice president of the Center for Automotive Research told PBS NewsHour, “…the cost of a vehicle, a new vehicle in the U.S. is going to go up somewhere between $1,100 and $5,400 a vehicle…It will hit GDP, up to [a] $34 billion hit to GDP. And we would see almost 400,000 American jobs disappear.”

Investors may be right about interest rates, too. Expectations for Fed rate cuts are rising. MarketWatch reported, “The fed fund futures market now show traders see a 72 percent chance of a rate cut at the Fed’s July 31 meeting, and an around 23 percent probability of a rate cut in the June 19 meeting.”

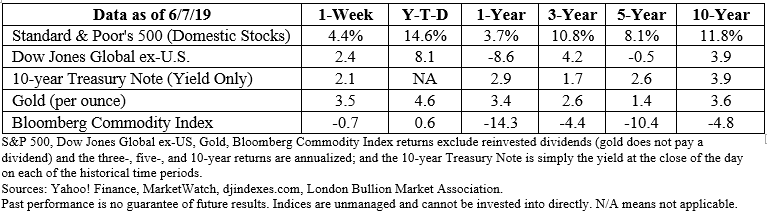

Last week, the Dow Jones Industrial Average and Standard & Poor’s 500 Index each gained more than 4 percent. The Nasdaq Composite was up 3.9 percent.

HOW MUCH IS THE WEDDING GOING TO COST YOU? You may not have noticed, but the average cost of weddings has risen sharply – and not just for the bride and groom and their parents. Costs have also increased for members of the wedding party and guests.

One reason for rising costs is the popularity of destination weddings. One-quarter of weddings take place far from home, as couples opt for sunset weddings on the beach in the Virgin Islands or nuptials shared under blossoming cherry trees in Washington, D.C. and Japan. TripSaavvy.com reported:

• The average destination wedding has a budget of $28,000 for 48 guests.

• Guests spend almost $700 to attend. Of course, international venues may have a higher price tag.

• The honeymoon cost for a destination wedding averages about $8,200.

In a Fox News opinion article, Liberty Vittert, Professor of Practical Data Science at Washington University, offered her thoughts:

“Yes, we all know that the cost of weddings has become ridiculously exorbitant, at an average cost of $33,391 per wedding (that’s almost $240 per guest). Meanwhile, the median household income in the United States is $59,039. It is so common to see this preposterous amount of money spent that it doesn’t really faze me anymore…As a wedding guest to an in-town wedding, you need to account for clothing, transportation, gift, and (potentially) booze. That can easily amount to $300. If it is out of town, hold your horses. By adding in travel and accommodation costs, you can easily be up to $700…If you are in the wedding, just throw your wallet in the toilet and flush.”

If you have relatives you’d rather not see, having your wedding on a mountaintop in Patagonia may be a sound choice. More than one-half of those surveyed said cost would prevent them from attending destination weddings.

There are other options. Couples could have small weddings near home or elope to exotic destinations and then have celebratory parties when they get home. Whoever is footing the bill would be able to bank the savings as an investment in the future.

Weekly Focus – Think About It

“Love recognizes no barriers. It jumps hurdles, leaps fences, penetrates walls to arrive at its destination full of hope.”

–Maya Angelou, Poet and author

By Kevin Theissen, Principal and Financial Advisor, HWC Financial, kevin@skygatefinancial.com